الحار منتجات

ملكنا الإخبارية

Chapter 6 Bethesda Mining Company Solution

SFSU 351 Case Chapter 6 Solution, S, 2016 - CHAPTER

Case CHAPTER 6 Solution for Fin 351 teacher David Distad. chapter case bethesda mining to analyze this project, we must calculate the incremental cash flows ... So, we will begin by calculating sales. Each year, the

获取价格

CHAPTER 6, Case #1 BETHESDA MINING - studylib

BETHESDA MINING. To analyze this project, we must calculate the incremental cash flows generated by the project. Since net working capital is built up ahead of sales, the initial

获取价格

Solved Case Study – Bethesda Mining Company Bethesda Mining

Bethesda Mining does not have enough excess capacity at its existing mines to guarantee the contract. The company is considering opening a strip mine in Ohio on 5,000 acres of

获取价格

Solved Need help with this home work, Please show how - Chegg

Need help with this home work, Please show how Payback, NPV, IRR and PI was calculated and results. Thank you very much. Question Read Chapter 6 Mini-Case: Bethesda

获取价格

Your solution’s ready to go! - Chegg

Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia and Kentucky. Please use Excel to solve the assignment

获取价格

Read Chapter 6 Mini-Case: Bethesda Mining Company (located in

Question. Read Chapter 6 Mini-Case: Bethesda Mining Company (located in Mini Cases section at end of Chapter 6). You have been approached by the president of Bethesda

获取价格

Solved BETHESDA MINING COMPANY Bethesda

Bethesda Mining does not have enough excess capacity at its existing mines to guarantee the contract. The company is consid- ering opening a strip mine in Ohio on 5,000 acres of land purchased 10 years ago for

获取价格

BETHESDA MINING COMPANY SOLUTION.pdf - Time 0

View BETHESDA MINING COMPANY SOLUTION.pdf from FINANCE 3415 at University of the West Indies at St. Augustine. Time 0 cash ... BETHESDA MINING COMPANY Bethesda Mining is a midsized coal

获取价格

财务管理Case1,含答案 - 财务管理Case1,含答案 - Case Case

Bethesda Mining does not have enough excess capacity at its existing mines to guarantee the contract. The company is considering opening a strip mine in Ohio on 5,000 acres of

获取价格

Solved Chapter 3 Homework Assignment 6 Help Save Exit - Chegg

Question: Chapter 3 Homework Assignment 6 Help Save Exit Submit Check my work Bethesda Mining Company reports the fallowing balance sheet information for 2018 and 2019 Prepare the 2018 and 2019 common-size balance sheets for Bethesda Mining.

获取价格

W3 Mini Case Bethesda Mining Co..docx - Course Hero

Read Chapter 6 Mini-Case: Bethesda Mining Company (located in Mini Cases section at end of Chapter 6). ... Affirmation By submitting my solution via BrightSpace (D2L) assignment tool, I affirm that I have had no conversation regarding this project with any persons other than (the instructor). ...

获取价格

Financial Analysis of Bethesda Mining Company Course Hero

View Bethesda Mining Solution_RRWJ.xlsx from MBA 643 at George Mason University. Chapter 6 Bethesda Mining Company Input area: Land cost Aftertax land value Equipment Equipment salvage Contract ... Bethesda Mining Solution RRWJ.xlsx - Chapter 6 Bethesda... Pages 4. Total views 2. George Mason University. MBA. MBA 643.

获取价格

Mini Case 2 - Bethesda Mining - TEMPLATE-2.xlsx - Mini Case...

Use the information from the mini case in chapter 6, Bethesda Mining, to answer the questions below. ... BETHESDA MINING COMPANY Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. ... View 4.6. FIN 2200 CB_NTL - Solution.pdf from FIN 2200 at University of

获取价格

Bethesda Mining Company Case Solution - ahecdata.utah

Solutions for Chapter 6 BETHESDA MINING COMPANY. oN24 CUSToMEr CASE STUDY based in bethesda, MD, the $12 billion company operates and franchises solutions@ON24 or call 18772029599 2 oN24 CUSToMEr CASE STUDY Bethesda Mining Company Case Solution \u0026 Analysis- Caseism Bethesda Mining

获取价格

Solved the replacement market price 15 d. At what level of - Chegg

Your solution’s ready to go! ... Read Chapter 6 Mini-Case: Bethesda Mining Company (located in Mini Cases section at end of Chapter 6). ... You have been approached by the president of Bethesda Mining Company with a request to analyze this project for possible investment Structure your response to the following questions as a professional ...

获取价格

Read Chapter 6 Mini-Case: Bethesda Mining Company (located in

Should Bethesda Mining take the contract and open the mine? Support your recommendation based on the above analysis. NEED TO SHOW CALCULATIONS! BETHESDA MINING COMPANY Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The

获取价格

SFSU 351 Case Chapter 6 Solution, S, 2016 - CHAPTER 6, Case BETHESDA

Case CHAPTER 6 Solution for Fin 351 teacher David Distad. chapter case bethesda mining to analyze this project, we must calculate the incremental cash flows ... So, we will begin by calculating sales. Each year, the company will sell 500,000 tons under contract, and the rest on the spot market. The total sales revenue is the price per ton under ...

获取价格

Solved Chapter 3 Quiz 6 Saved 5 Bethesda Mining Company

Chapter 3 Quiz 6 Saved 5 Bethesda Mining Company reports the following balance sheet information for 2018 and 2019. ebook BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 58,042 $73,306 Accounts payable $ 188,422 $

获取价格

Case 1 Ch 6 Bethesda Mining Group Project - Chapter 6...

View Homework Help - Case 1_Ch 6_Bethesda Mining Group Project from FIN 615 at University of Maryland, University College. Chapter 6 Bethesda Mining Input area: Land cost Aftertax land

获取价格

CHAPTER 7, Case #1 BETHESDA MINING - studylib

CHAPTER 7, Case #1 BETHESDA MINING To analyze this project, we must calculate the incremental cash flows generated by the project. ... we will begin by calculating sales. Each year, the company will sell 600,000 tons under contract, and the rest on the spot market. The total sales revenue is the price per ton under contract times 600,000 tons ...

获取价格

财务管理Case1,含答案 - 财务管理Case1,含答案 - Case Case study-Bethesda mining company ...

Case study----Bethesda mining company. Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The company operates deep mines as well as strip mines. Most of the coal mined is sold under contract, with excess production sold on the spot market.

获取价格

chapter6.doc - Chapter6 Problem 1 BETHESDA MINING COMPANY...

Chapter6 Problem 1 BETHESDA MINING COMPANY Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The company operates deep mines as well as strip mines. Most of the coal mined is sold under contract, with excess production sold on the spot market. The coal

获取价格

SOLUTION: Bethesda Mining Company Case Study - Studypool

Bethesda Mining Company Case Study. Content type User Generated. Subject Accounting. Type Homework. Uploaded By OryyOregvr. Pages 5. Rating Showing Page: 1/5. ... Refer to Chapter 3 of the David text to learn how to complete an CPM Matrix.Step 2: Open your Strategic-Planning Template. Click on the CPM tab at the bottom of the

获取价格

CHAPTER 7, Case #1 BETHESDA MINING - studylib

CHAPTER 7, Case #1 BETHESDA MINING To analyze this project, we must calculate the incremental cash flows generated by the project. ... we will begin by calculating sales. Each year, the company will sell 600,000 tons under contract, and the rest on the spot market. The total sales revenue is the price per ton under contract times 600,000 tons ...

获取价格

财务管理Case1,含答案 - 财务管理Case1,含答案 - Case Case study-Bethesda mining company ...

Case study----Bethesda mining company. Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The company operates deep mines as well as strip mines. Most of the coal mined is sold under contract, with excess production sold on the spot market.

获取价格

chapter6.doc - Chapter6 Problem 1 BETHESDA MINING COMPANY...

Chapter6 Problem 1 BETHESDA MINING COMPANY Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The company operates deep mines as well as strip mines. Most of the coal mined is sold under contract, with excess production sold on the spot market. The coal

获取价格

SOLUTION: Bethesda Mining Company Case Study - Studypool

Bethesda Mining Company Case Study. Content type User Generated. Subject Accounting. Type Homework. Uploaded By OryyOregvr. Pages 5. Rating Showing Page: 1/5. ... Refer to Chapter 3 of the David text to learn how to complete an CPM Matrix.Step 2: Open your Strategic-Planning Template. Click on the CPM tab at the bottom of the

获取价格

Solved Submit Save Exit Chapter 03 Saved Help Check my

You'll get a detailed solution from a subject matter expert that helps you learn core concepts. ... Submit Save Exit Chapter 03 Saved Help Check my work 6. BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Liabilities and Owners' Equity Assets Current assets Cash Current liabilities 10 $

获取价格

Solved Problems Excel Simulations - Chapter 03 Saved Help

You'll get a detailed solution from a subject matter expert that helps you learn core concepts. ... Chapter 03 Saved Help S. 6 2018 2019 10 points BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 67,906 $85,508 Accounts

获取价格

Chapter 8 Case Study Bethesda Mining Co Proforma - Course

CHAPTER 8B BETHESDA MINING COMPANY To analyze this project, we must calculate the incremental cash flows generated by the project. Since net working capital is built up ahead of sales, the initial cash flow depends in part on this cash outflow. So, we will begin by calculating sales. Each year, the company will sell x tons under contract, and the rest on

获取价格

Chapter 6 Mini Case Bethesda Mining.xlsx - Course Hero

View Homework Help - Chapter 6 Mini Case _ Bethesda Mining.xlsx from MBA 573 at Point Park University. Capital Expenditures Equipment Cost Equipment Mkt Value at Time 4 Land Value at Time 0 Operating

获取价格

Tony Case 6 BETHESDA MINING COMPANY.docx - 1 Chapter 6

View Tony Case 6 BETHESDA MINING COMPANY.docx from FINANCE BAC 100 at Jomo Kenyatta University of Agriculture and Technology, Nairobi. 1 Chapter 6 Mini Case: Bethesda Mining Company Tony. AI Chat with PDF. Expert Help. Study Resources. ... Solutions Available. Belmont University. FIN 6100. test prep.

获取价格

MinicaseCh06 assignmentVer2.xlsx - Chapter 6 Bethesda Mining Company ...

View MinicaseCh06_assignmentVer2.xlsx from FNAN 401 at George Mason University. Chapter 6 Bethesda Mining Company Submitted by: From the data provided in the case: Land cost Aftertax land

获取价格

327898061-Bethesda-Mining-Company-docx - Running Head:...

View Notes - 327898061-Bethesda-Mining-Company-docx from ENTREPRENE 100 at University of Kuala Lumpur. Running Head: BETHESDA MINING COMPANY Bethesda Mining Company Elijah Clark Walden. AI Homework Help. Expert Help. Study Resources. Log in Join. 327898061-Bethesda-Mining-Company-docx - Running Head:... Pages 8.

获取价格

Chapter 6 Mini Cases - Bethseda Mining Company Answers: NPV...

View Homework Help - Chapter 6 Mini Cases from BUNW-A 512 at Indiana University, Northwest. Bethseda Mining Company Answers: NPV = IRR = MIRR = Payback Period (in years)= Profitability Index= Should

获取价格

Bethesda Chapter 8 Case - BETHESDA MINING COMPANY Bethesda Mining

BETHESDA MINING COMPANY Bethesda Mining is trying to determine whether or not it should accept a contract to open a new mine in order to be able to provide coal for Mid-Ohio Electric Company. They want to analyze the project to determine whether or not they should open the new mine. They want to find the payback period, profitably index, net present

获取价格

Solved CHAPTER 3 Working with Financial Statements LO 3 14. - Chegg

DuPont Identity Suppose that the Bethesda Mining Company had sales of $2.751.332 and net income of $86.432 for the year ending December 31. 2019. Calculate the DuPont identity. LO 3 18. DuPont Identity The Taylor Company has an ROA of 7.6 percent, a profit margin of 5.2 percent, and an ROE of 14 percent. What is the company's total asset

获取价格ما الذي تفعله الحكومة لتقليل آثار التلوث الناجم عن صناعة التعدين

توفير الطاقة محطم

التلك آلات طحن خام الحجر كسارة نيجيريا

كسارة متنقلة من السعودية

جنة الانتخابات المركزية كسارة الفك المحمولة بيع

تكوين مصنع تكسير الحجر 500

آلة طحن الحجر نوع سعر مطحنة ريمون

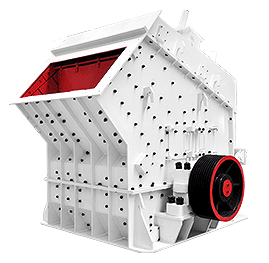

كسارة الصدم الصغيرة pdf

كسارة محمولة على الزاحف الهند

عكاز متنقل في الولايات المتحدة

تستخدم اليابان آلة طحن الحجر

مجفف رمل للبيع في ولاية مهاراشترا

مبدأ مطحنة الغروانية

مؤسسة لبيع المعدات الثقيلة

حجم حجر قلم طحن اليد

وتكاليف الكسارات الشعبي

الرسوم المتحركة مطحنة الفحم

supply of small hand

مصنعين الرمل وحدة غسيل المركبات

أسعار الكسارة والإنتاج في الساعة

mtm سلسلة طاحونة شبه منحرف سرعة متوسطة

ماكينة jcb 3cx للبيع بالمغرب

كسارة فكية C1101200 طن لكل مربى

طحونتالشر الحقةالخم سة

مرفق تكسير الصخور حفار

عملية الحجر النموذجية لتعدين الذهب

حول لدينا

تأسست شركة Henan Lrate للعلوم والتكنولوجيا المحدودة التي تصنع معدات التكسير والطحن الكبيرة والمتوسطة الحجم في عام 1987. وهي شركة مساهمة حديثة مع البحث والتصنيع والمبيعات معًا.

على مدار أكثر من 30 عامًا ، تلتزم شركتنا بنظام الإدارة العلمية الحديث والتصنيع الدقيق والريادة والابتكار. الآن أصبحت LIMING رائدة في صناعة تصنيع الآلات المحلية والخارجية.

2021/07/20

2021/07/20